How to attain financial freedom

You are just one step away to ultimate financial cheatsheet 👇

Financial Wellbeing

Business

Job

There are mainly three aspects of wealth creation: Financial wellbeing, business and job. Let’s dive deep into each domain and see where we stand in the world and how we can level up.

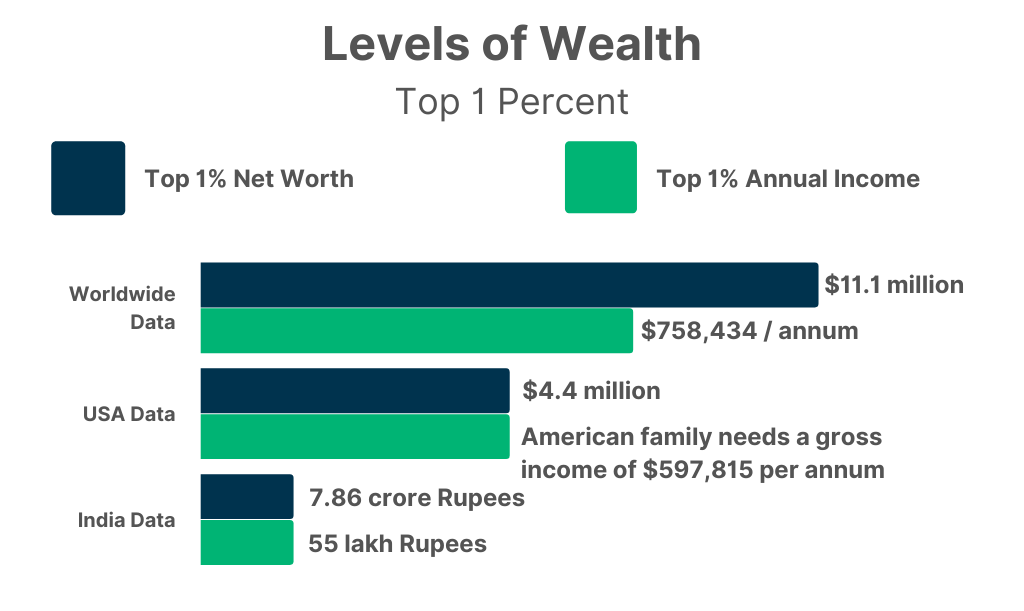

Where do you stand in the world financially?

Little Secret of Wealthy Ones:

The financial system was built to help people save money at lowest risk. But eventually, the system got corrupted around the world and political power started taking decisions which initiate inflations and high taxes which makes the common people lose money over time. This is the reason financial wellbeing awareness and proper action taking plan is needed for people at different income slabs. It is important to reinforce financial wellbeing in our mind and urge ourselves to take actions to beat inflation and grow money over time.

Wealthy ones stay away from banks and invest their money in diversified ways. This is the only secret which set the wealthy ones aside. They don't have any magic formula!

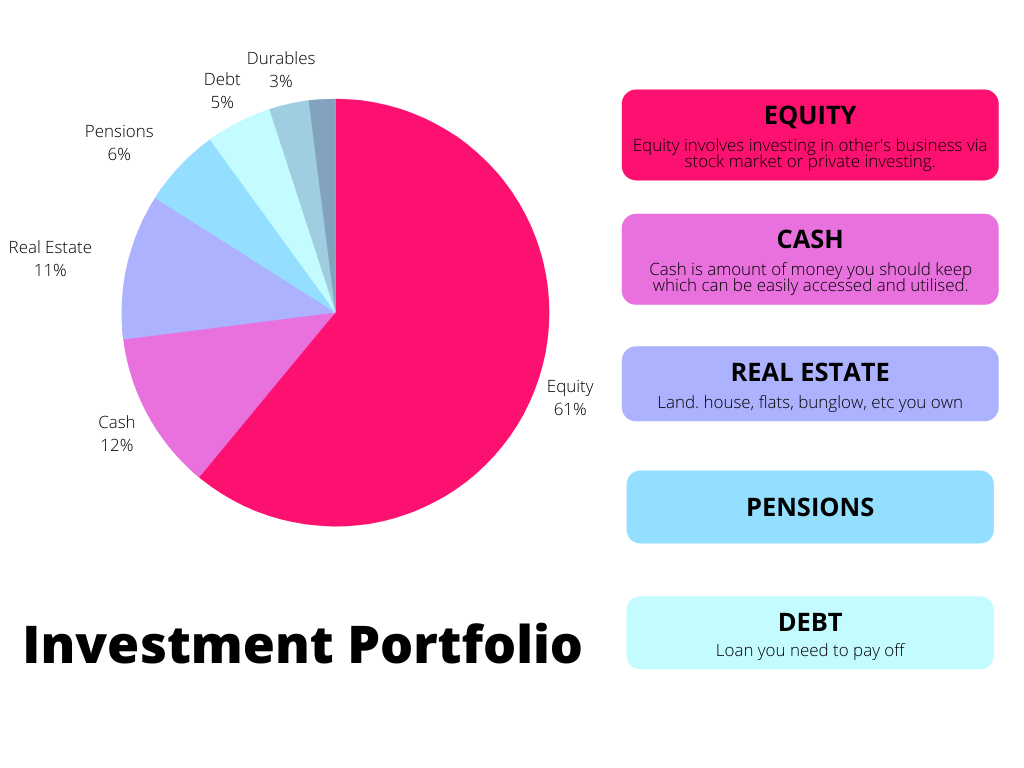

Here is a piece of data which explains how the top 1 percent invest their money:

The Harsh Fact:

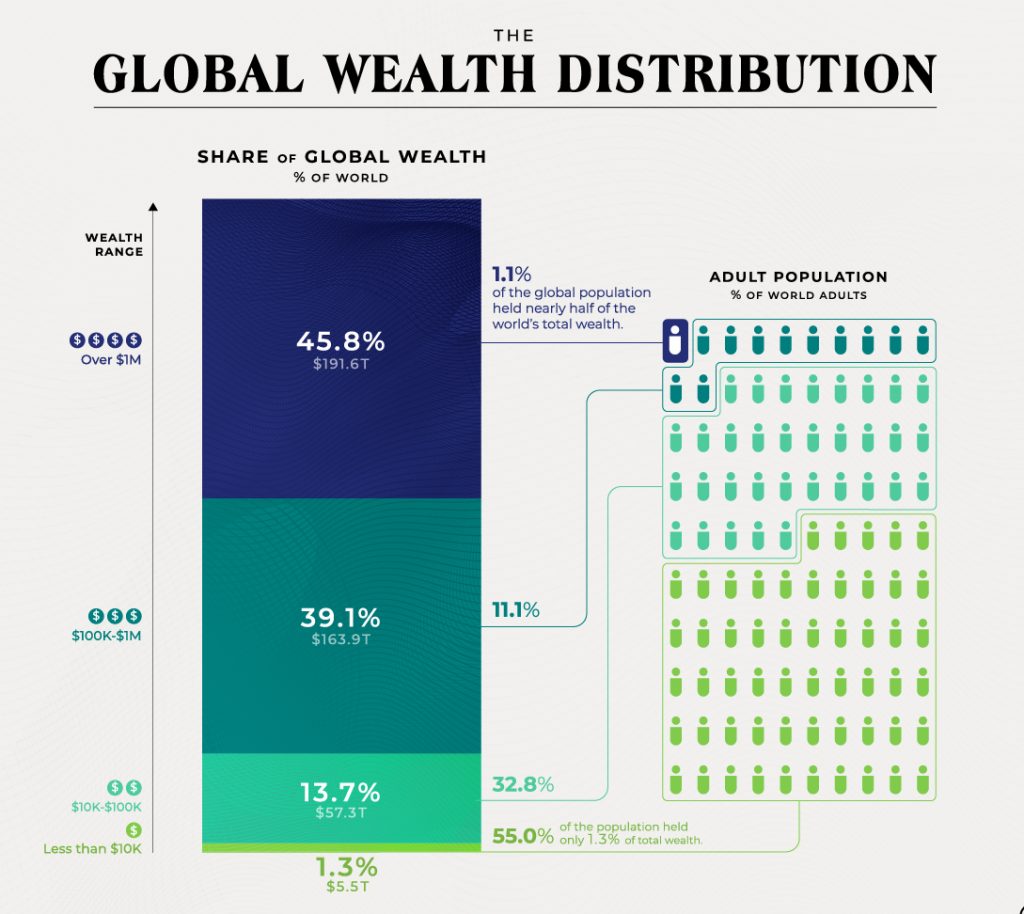

The top one percent of households globally own 43 percent of all personal wealth, while the bottom 50 percent own only one percent.

That top-tier one percent amounts to 52 million people who are all millionaires in net wealth (after debt). Within this elite fraction are 175,000 ultra-wealthy people (those with over $50 million in net wealth), or 0.1 percent, who in turn own 25 percent of the world’s wealth.

With time, rich is becoming richer, and poor is getting poorer. We must have heard it a lot of times. But we don't really understand it in depth. The fact that rich people beat inflation and grow their money overtime is what makes them come out of the financial trap and get richer. On the other hand, ordinary people fall for the financial trap of the government and banks due to which they could not beat the inflation and hence get poorer with time.

The only way to average down the world and reduce the wealth gap is when the ordinary people outperform the top 1 percent in their own game. One needs to use time efficiently, act differently and use every opportunity out there.

Banks & Government: Inflation Scam

Consider banks as a business which makes money from ordinary people like you who use bank accounts to deposit money and banks lend your money to the loan takers around the country. There is something called inflation which means the cost of goods and services increases in an economy. In the time of financial crisis, the economy faces inflation, and ordinary people are the ones who face the consequences of increased prices. For example, last year you bought a product for 100 dollars or 7000 Rupees. This year it will cost 120 dollars or 8500 Rupees. This is how you got defrauded or poorer because of inflation as the price to be paid by you is more whereas your salary or income is almost same. To beat inflation, you need to grow your money over time. One should keep the least percentage of their wealth in the banks. The maximum amount of wealth should be invested in the stock market and other investment channels post proper research & analysis.

FINANCIAL WELLBEING

What is discretionary income?

Discretionary income is money left over after paying your taxes and other living expenses (rent, mortgage, food, heat, electric, clothing, etc.).

SIP (50% of discretionary income)

There is something called non-performing asset in banks. Banks lend bad loans to big businesses and those businesses fail to return the money which in turn becomes non-performing asset for the banks. To counter-effect this loss, banks lessen the interest they pay to the ordinary people who save their hard-earned money. In the worst-case scenario, such banks go into an unavoidable financial crisis and either they stop paying their depositors or the government would need to step in to save the bank.

On an average scale, the economy faces inflation per year. So, the value for our money decreases over time. To avoid getting poorer with time, one needs to invest their money wisely. For example, if the inflation is 5% per year and the bank is giving you an interest of 3%, then your money is losing 2% of value per year.

The most stable way to save money and grow over time with the least risk is to invest in safe mutual funds as per your analysis and long-term goal. Invest a decent amount every month as SIP and let the money grow on its own without falling into the financial trap of banks.

Value Investing (20 % of discretionary income)

Value investing is nothing but investing in quality small stocks which have high potential to become multi-bagger over time. These stocks are undervalued. You make the decision to buy these stocks based on strong fundamental analysis. It's a buy-and-hold strategy.

Real Estate (10 % of discretionary income)

Real estate is overall the best long-term investment. It provides better return on an average than investing in stocks without much analysis over time.

Quick to Get Rich Scheme (5 % of discretionary income)

High-risk investment in cryptocurrency, flipping domains, websites, nft's, etc.

Cash (15 % of discretionary income)

Keep emergency funds to be used at the time of need as other assets take time to sell off and cash out.

BUSINESS

Find your passion and then nail it down to something that you can offer to the audience. Monetize your passion and see how you can make money out of it. There are various stages of business formation as follows:

① Offline vs Online Business

Most of you get confused whether to start an offline business or online. There is certainly nothing to worry about. First do some soul searching, find a business you want to start.

② Brand Name Selection

Now, you have to think about the brand name. Remember, this name will be there forever. So, be cautious.

③ Idea Stage

Take a copy and sketch down a rough idea of your business or do it online (WordPad, coggle, paint, etc.)

④ Business Online Presence

Getting a website or any other sort of online presence (Facebook page, Instagram page) for the business is necessary whether it is offline or online.

⑤ Setting Up

Setting up the business and business plan. If it’s offline, then setting up the shop or premises. Get mandatory things done like obtaining a license, setup business tax as per your country’s legal structure.

⑥ Hiring workers/Team Members

Hiring workers for offline business. Hiring freelancers or team members for online business. If you think that you lack certain skill and don’t want to learn it, you can also get a business partner.

Product Management & Design (Optional)

Product management is an important aspect of business, product management oversees the lifespan of a product from the beginning up until the very end.

⑦ Growth Hacking

Replace “marketing” with word “growth”. You need to master growth hacking to ensure that your business awareness increases exponentially.

⑧ Playing with the Data

Find businesses which are similar to your business. Check the data available online and utilize it to your advantage.

⑨ Competitor Analysis

Analyzing your competitors on the basis of their type of customers based on purchasing power, age, gender, etc.

⑩ Feedback Loop

Collect feedback verbally or via your website or text/WhatsApp or any other online platform. Your customer views matter.

⑪ Must have Skills

Top skills on an average of successful businessman includes Persistence and not giving up (95% weightage to success), Consistency (95% weightage to success), etc.